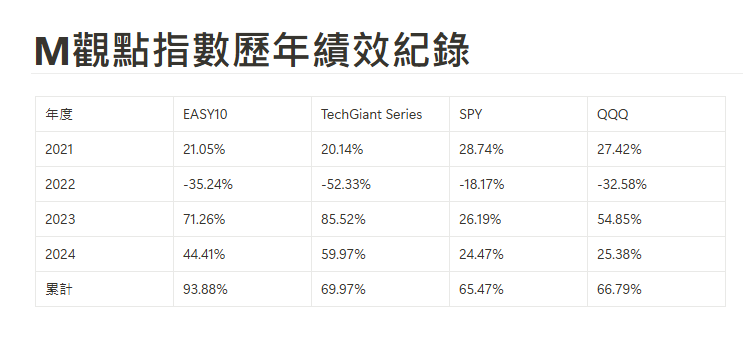

以後每年年底,會編列下一年版本的這兩個指數,一個是 Easy10 簡單十指數,投資簡單十等分,人人都能執行。另一個是專注於科技巨頭與新興獨角獸的 TechGiants 25 科技巨頭二五指數。未來我們會針對這兩個指數的績效做長期的追蹤,看看能不能長期勝過 S&P500 與 Nasdaq100 這兩個主要指數。

而等到過完一整年,我將會統計一下這兩個指數在該年的績效,並且跟其他的主要指標對標一下成績單。

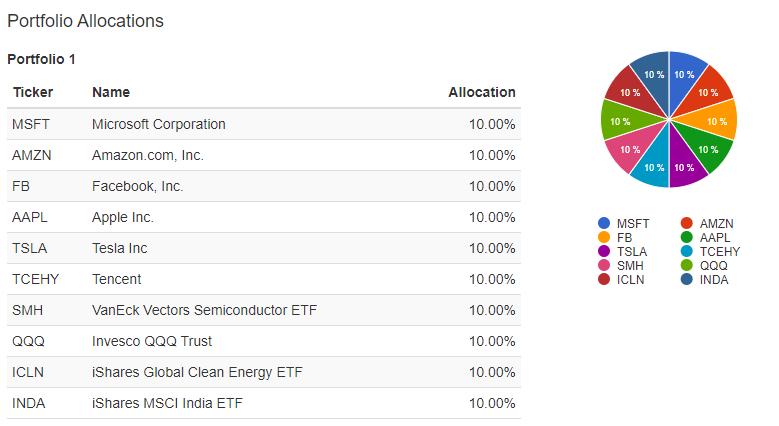

簡單十 2021 版本 –

| Ticker | Name | Allocation |

|---|---|---|

| MSFT | Microsoft Corporation | 10.00% |

| AMZN | Amazon.com, Inc. | 10.00% |

| FB | Facebook, Inc. | 10.00% |

| AAPL | Apple Inc. | 10.00% |

| TSLA | Tesla Inc | 10.00% |

| TCEHY | Tencent | 10.00% |

| SMH | VanEck Vectors Semiconductor ETF | 10.00% |

| QQQ | Invesco QQQ Trust | 10.00% |

| ICLN | iShares Global Clean Energy ETF | 10.00% |

| INDA | iShares MSCI India ETF | 10.00% |

TechGiants 25 科技巨頭二五 2021

| Ticker | Name | Allocation |

|---|---|---|

| MSFT | Microsoft Corporation | 8.00% |

| AAPL | Apple Inc. | 8.00% |

| AMZN | Amazon.com, Inc. | 8.00% |

| GOOG | Alphabet Inc. | 8.00% |

| FB | Facebook, Inc. | 8.00% |

| TSLA | Tesla Inc | 4.00% |

| NFLX | Netflix, Inc. | 4.00% |

| SE | Sea Ltd | 4.00% |

| SHOP | Shopify Inc. | 4.00% |

| NVDA | NVIDIA Corporation | 4.00% |

| ADBE | Adobe Systems Incorporated | 4.00% |

| TSM | Taiwan Semiconductor Manufacturing Company Ltd. | 4.00% |

| BABA | Alibaba Group Holding Limited | 4.00% |

| TCEHY | Tencent | 4.00% |

| CRM | Salesforce.com Inc | 4.00% |

| ZM | Zoom Video Communications Inc | 2.00% |

| FVRR | Fiverr Intl Ltd | 2.00% |

| NOW | ServiceNow, Inc. | 2.00% |

| OKTA | Okta Inc | 2.00% |

| CRWD | Crowdstrike Holdings Inc | 2.00% |

| NET | Cloudflare Inc | 2.00% |

| SNOW | Snowflake Inc. | 2.00% |

| AYX | Alteryx Inc Cl A | 2.00% |

| PLTR | Palantir Technologies Inc | 2.00% |

| SPOT | Spotify Technology SA | 2.00% |

我們會在 2022 年年初,來對比 2021 年,這兩個指數對比其他主要指數的績效。